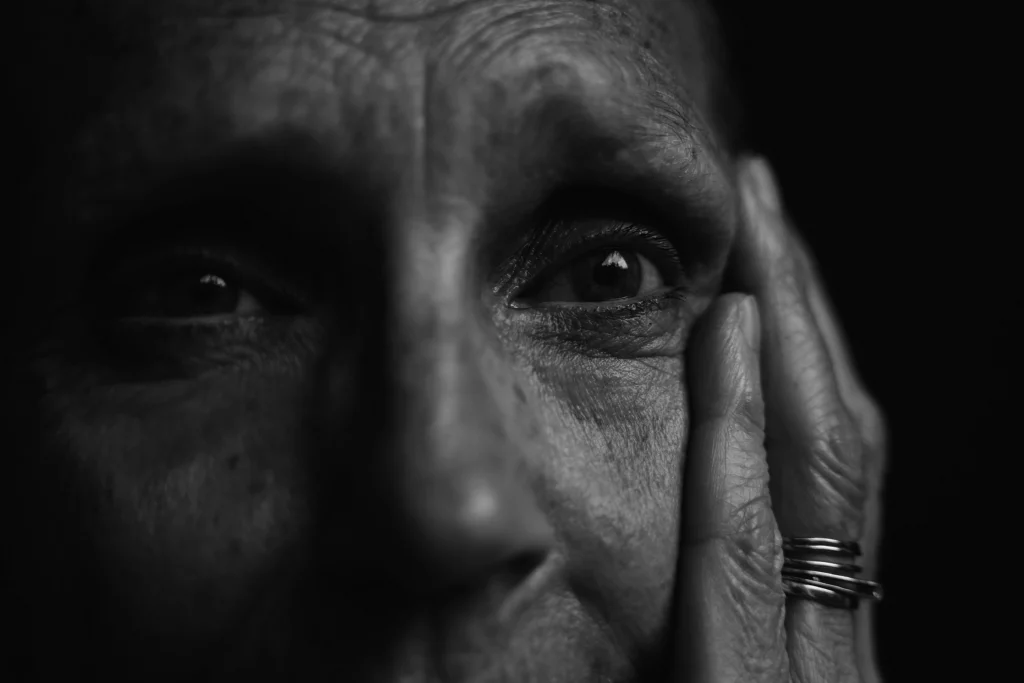

The International Network for the Prevention of Elder Abuse and the World Health Organization launched World Elder Abuse Awareness Day in June of 2006 to encourage individuals, organizations, and communities to raise awareness about neglect, exploitation, and abuse of the senior population.

In honor of WEAAD, we are working to educate the community on different types of elder abuse, prevention, recognizing signs that abuse is taking place and how to report it.

Some methods of financial exploitation are perpetrated by strangers, generally in the form of impostor scams or home improvement scams. Financial abuse may also take the form of in-home caregivers keeping change from errands, nursing home staff taking cash from resident rooms, or financial planners and advisors misusing assets.

More often though, it is close family members that are committing acts of financial abuse. Spouses and adult children may outright steal an elder’s money or possessions, or more covertly, trick them into signing legal documents granting them the authority to access financial assets. Manipulating elder family members into changing existing legal documents, like a will, is another form of financial abuse. Family members may not always mean to be financially abusive when taking advantage of generous parents or grandparents. They often don’t realize that their loved ones will jeopardize their own financial security by giving too much. Some may feel entitled to help themselves to an elder’s finances to compensate for unpaid caregiving they may do for the elder.

Putting certain preventive measures in place can help protect a person and their aging loved ones. Taking the time to draft detailed Power of Attorney documents while a person is still sharp ensures that a financial agent has limited and specific authority, rather than a more broad legal authority of the principal’s finances. Developing a relationship with an elder family member’s caregivers also decreases the chance that they exploit them financially, making the care workers aware that someone is paying attention.

Staying connected with the seniors in your family through phone calls, visits, and emails allows you the opportunity to identify signs that abuse is taking place. Some of those signs can be:

-

Large amounts of money missing from the elder’s bank or investment accounts

-

Sudden change in spending habits. Changes to the “authorized user” list for credit cards and other accounts may also be a sign they are being taken advantage of.

-

Missing possessions may alert you to theft or pressure from someone to sell things to them under fair market value.

-

Alternatively, noticing a lot of new things that the elder wouldn’t normally purchase can be a sign that someone is having the elder make purchases for them.

-

A person who has suddenly become interested in the individual’s assets or is suddenly “best friends” may have nefarious intentions.

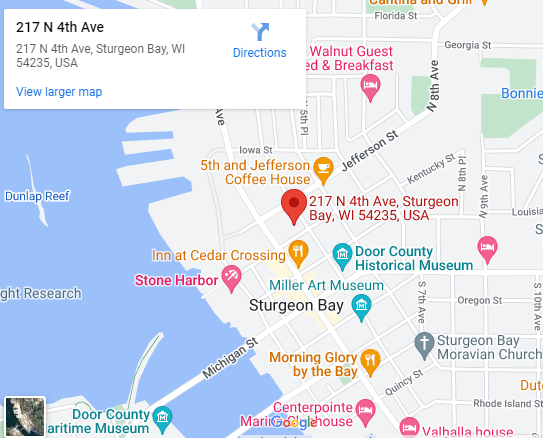

If you suspect that elder financial abuse has taken place, you can contact your local Adult Protective Services agency. It can also be helpful to consult an attorney. At Silver Divorce Wisconsin, we work with clients to help preserve important family relationships whenever possible. When those relationships become too harmful, however, we can help empower abuse victims to protect themselves with restraining orders, domestic abuse injunctions, and individual at-risk injunctions.

Disclaimer: This blog post is made available for educational purposes only. It should not be relied upon for legal advice and is not a substitute for legal research or a consultation with a qualified attorney.